How do you think a place like Quebec will fare in the 'slide' and 'cliff' phases?

I think Quebec has a lot of smart people that will figure out new energy solutions.

Posted 19 April 2005 - 09:57 PM

How do you think a place like Quebec will fare in the 'slide' and 'cliff' phases?

Posted 19 April 2005 - 10:01 PM

So, um, out of curiosity, what did the economist say?

Posted 19 April 2005 - 10:11 PM

Purified uranium doesn't magically jump out of the ground in Africa or Australia, fly across the ocean and then assemble into atomic piles in the U.S. And all the Homer Simpsons who work at the nuclear power plant need gasoline to commute.

Posted 24 April 2005 - 06:34 PM

Direct links to BP Statistical Review of Oil production:The Claim

This is a scaled claim that will pay (5*(the first year-2000)) between 2004 and 2020 in which oil production has declined by at least 3% from the previous year according to the BP Statistical Review of World Energy-and is followed by another year with a decline of at least 3%. If there is no such year, this claim pays 1.

Note: the last year for which the judge will consider production figures are those for 2020.

Edited by lightowl, 24 April 2005 - 06:54 PM.

Posted 26 April 2005 - 05:13 AM

Posted 26 April 2005 - 05:42 AM

Analyst fears global oil crisis in three years

John Vidal, environment editor

Tuesday April 26, 2005

The Guardian

One of the world's leading energy analysts yesterday called for an independent assessment of global oil reserves because he believed that Middle Eastern countries may have far less than officially stated and that oil prices could double to more than $100 a barrel within three years, triggering economic collapse.

Matthew Simmons, an adviser to President George Bush and chairman of the Wall Street energy investment company Simmons, said that "peak oil" - when global oil production rises to its highest point before declining irreversibly - was rapidly approaching even as demand was increasing.

"This is a new era," Mr Simmons told a conference of oil industry analysts, government officials and academics in Edinburgh. "There is a big chance that Saudi Arabia actually peaked production in 1981. We have no reliable data. Our data collection system for oil is rubbish. I suspect that if we had, we would find that we are over-producing in most of our major fields and that we should be throttling back. We may have passed that point."

Mr Simmons told the meeting that it was inevitable that the price of oil would soar above $100 as supplies failed to meet demand. "Demand is pulling away from supply...and we have to ask whether we have the resources that we think we do. It could be catastrophic if we do not anticipate when peak oil comes."

Posted 30 April 2005 - 02:08 PM

Expect oil at $150 in a decade, Soros colleague warns

London • 28 April 2005 • Jim Rogers, co-founder with George Soros of the Quantum Fund, has predicted oil will be at $150 within the next 10 years.

Speaking at the Hedge Funds World Global Opportunities 2005 conference, Rogers was negative on chances of the oil price being forced down in the near future.

"The question on oil will be how high the price goes and stays, because there may be vast amounts of oil in the world but no one has discovered a great oilfield in over 35 years.

"The Alaskan and Mexican fields are in decline, and while the North Sea has made the UK one of the great oil exporters in the last 20 years, within the decade the UK will be a net importer.

"In the 1960s we discovered North America, Mexico and the North Sea, and the world knew the oil would come to market. But the price of oil went up 10 times, because it could not get to market quickly enough.

"If you think the price of oil is going to $32 and staying there, let me know where the oil is coming from. I expect the price will be $100–$150 within the decade, and the bull run in commodities will come to an end when it reaches $110."

Posted 05 May 2005 - 12:47 AM

Small oil company touts discovery

MAY. 4 5:32 P.M. ET A tiny oil company has snapped up leasing rights to a half-million acres in central Utah that it says could yield a billion barrels or more of oil.

Geologists are calling it a spectacular find -- the largest onshore discovery in at least 30 years, located in a region of complex geology long abandoned for exploration by major oil companies. It's turning out to contain high-quality oil already commanding a premium at refineries....

"It's just very highly unlikely because the U.S. onshore has been picked clean, if you will," said Fadel Gheit, senior oil analyst at Oppenheimer & Co. in New York.

"That's like finding a wallet in the subway after all the cleaners went through it. It's possible, but very highly unlikely," he said.

Posted 05 May 2005 - 02:00 PM

Well, it's in the U.S., so you know that not one drop will be exported. The world might go through that in 11 days, but the U.S. goes through that every seven weeks or so.What nonsense. The world consumes a billion barrels of oil every eleven days. This field won't make any real difference.

Posted 05 May 2005 - 02:25 PM

Well, it's in the U.S., so you know that not one drop will be exported. The world might go through that in 11 days, but the U.S. goes through that every seven weeks or so.

Posted 05 May 2005 - 02:42 PM

Posted 09 May 2005 - 11:56 AM

http://www.nytimes.c...s/09energy.html?

When It Comes to Replacing Oil Imports, Nuclear Is No Easy Option, Experts Say

By MATTHEW L. WALD

Published: May 9, 2005

WASHINGTON, May 8 - President Bush has proposed reducing oil imports by increasing the use of nuclear power, which he said in a recent speech was "one of the most promising sources of energy."

There is a problem, though: reactors make electricity, not oil. And oil does not make much electricity.

Nuclear reactors produce about 20 percent of the electricity used in the United States and about 8 percent of the total energy consumed. Oil accounts for 41 percent of energy consumption.

Could a few dozen more reactors, in addition to the 103 running now, cut into oil's share of the energy market?

"Indirectly, but very indirectly," said Lawrence J. Goldstein, president of the Petroleum Industry Research Foundation, a nonprofit group that studies the economics of oil. People who think nuclear power is a way to reduce oil imports are "confusing several issues," he said.

Peter A. Bradford, a former member of the Nuclear Regulatory Commission, added, "No one knowledgeable about energy policy would link nuclear power and gasoline prices."

In the puzzle of energy consumption and production, however, experts point to three intersections of oil and nuclear power that would offer opportunities to cut demand for oil, pushing down its price and strategic significance. But all are limited, clumsy, expensive or dependent on new technologies whose success is not guaranteed, the experts say.

The first option is to replace the oil used to make electricity with new nuclear reactors. But most of the oil in the electric sector has already been replaced, by coal.

According to the Energy Department, last year the electric utilities used about 207 million barrels of oil, or less than 600,000 barrels a day. (Total American consumption of oil is about 20.5 million barrels a day.)

Even the 600,000-barrel figure is higher than what nuclear reactors could replace, because some of that oil is used in generators that run only a few hundred hours a year. Reactors must run continuously, so they could not replace the oil-fired plants that are used only intermittently.

The electric system consumes another fuel that nuclear power could replace: natural gas. Last year, American utilities burned just under 5.4 trillion cubic feet of natural gas, out of total consumption of 22.3 trillion cubic feet.

"You can get a scenario where nuclear would free the gas to go to other things," replacing oil and gasoline, said Thomas Capps, the chairman of Dominion, one of several electric companies that have expressed interest in building new nuclear reactors. "You can run cars on natural gas," he said.

The technology for that is available, but not many people use it. According to the Natural Gas Vehicle Coalition, a lobbying group, about 130,000 such vehicles are on American roads today, out of more than 200 million. After decades of promoting natural gas, federal and state governments have made some headway in persuading commercial fleets to switch. But they have essentially given up on selling natural gas to ordinary consumers, who have been unwilling to convert their vehicles to use it.

There is also little economic incentive behind using natural gas. Mr. Goldstein noted that the current wholesale price of gas, about $7 per million B.T.U. (the standard unit by which gas is sold), is the equivalent of $42 per barrel for oil. But oil now sells for about $50 a barrel, which means the price difference is not enough to induce a switch.

Gas must also be pressurized for a car to hold enough to travel more than a few miles; pressurizing it and distributing it to service stations would add expense.

But there is another way that nuclear reactors could influence the oil supply, one that bypasses electricity completely. Nuclear engineers are working on designs and materials for a new class of reactors - which could be ready in about 20 years - whose main product would be heat.

The Idaho National Laboratory in Idaho Falls, which is owned by the Department of Energy, is working on ways to take very hot steam from a nuclear reactor, then run a small electric current through it to separate the water molecules into hydrogen and oxygen. If that can be done more cheaply than the current method of producing hydrogen, which uses natural gas, the hydrogen could be used at refineries to make components of gasoline.

Gasoline is made of molecules with a certain ratio of carbon to hydrogen. Part of each barrel of oil consists of molecules with too much carbon to be useful in gasoline; instead, those molecules are used only in low-value products like asphalt and tar.

The technology exists for refineries to break up those molecules and add hydrogen, until the hydrogen-carbon ratio is suitable for making gasoline or diesel.

David Lifschultz, chief executive of Genoil, a company that makes systems for using hydrogen at refineries, says the oil supply being exhausted first is light oil, which has many components that can be used in gasoline. Heavy oil, with components high in carbon, is far more abundant and often sells at a discount of $20 or $25 a barrel, he said.

Available technology could convert 16 million barrels a day of heavy oil, about a sixth of the world supply, into gasoline components, Mr. Lifschultz said, driving down the price of light oil.

J. Stephen Herring, a consulting engineer at the Idaho lab, explained two other ways for reactors to make motor fuel.

Canada has vast reserves of shale oil, now being converted to ingredients of motor fuel by using natural gas. The gas is used to heat the shale to make its oil flow more easily, and hydrogen, also obtained from the natural gas, is incorporated into the oil to make it suitable for use in gasoline. But a nuclear reactor could do those jobs, delivering both hydrogen and steam for cooking the oil out of the rock, Mr. Herring said.

Another strategy, he said, would be to break down coal, shale oil or other hydrogen fuels into a gas comprising hydrogen and carbon monoxide. At high pressure, these materials could form molecules suitable for making gasoline or diesel. A reactor could provide the energy required.

But using a reactor to make the ingredients of gasoline is many years away; the new reactors being considered by utilities are similar to the ones running now. The experts say that only after several of those have been built and have run for a few years is a private company likely to try something more adventurous.

Mr. Herring did not fault that strategy. "If I were responsible for spending the billion dollars," he said, "I'd be conservative, too."

*************

No New Refineries in 29 Years? There Might Well Be a Reason

Posted 09 May 2005 - 12:11 PM

http://www.nytimes.c...artner=homepage

No New Refineries in 29 Years? There Might Well Be a Reason

By JAD MOUAWAD

Published: May 9, 2005

About 100 miles southwest of Phoenix, in a remote patch off Interstate 8, Glenn McGinnis is seeking to do something that has not been done for 29 years in the United States. He is trying to build an oil refinery.

Part of his job is to persuade local officials and residents to allow a 150,000-barrel-a-day refinery in their backyard - no small task. Another is to find investors ready to risk $2.5 billion in a volatile industry. So far, the effort has consumed six years and $30 million, with precious little to show for it.

Oil industry analysts and trade organizations like the American Petroleum Institute say they know of no one else doing the same thing.

Even so, Mr. McGinnis - an industry veteran who joined Arizona Clean Fuels last year as chief executive to give the project more heft against long odds - cleared a significant hurdle recently when Arizona awarded him a crucial emissions permit. Still ahead are countless rounds of negotiations with local, state and federal agencies to secure dozens more permits.

Meanwhile, the 1,400-acre site picked for the refinery, an old citrus grove near the Mexican border, remains empty, a sign of why the United States is now grappling with an acute shortage of plants that can refine the more than 20 million of barrels of crude oil that the country consumes every day.

The last refinery to be completed in the United States was in 1976, and Mr. McGinnis knows all too well that community and political opposition squashed earlier projects. His proposed refinery in Arizona has already been forced away from its original site near Phoenix, in 2003, after the state considered expanding the city's clean-air limits.

But times may be changing, said Mr. McGinnis, an oil business veteran of 33 years who has run refineries in the United States and Aruba.

"The moon and the stars have aligned for us," he said, speaking on his cellphone between discussing crude oil supplies with Mexico's state oil company. "We're halfway through, and we still have a lot of work."

Long considered the ugly duckling of the oil industry, the refining business is now in the spotlight as Americans complain about sticker shock at the gasoline pumps and higher energy prices over all.

President Bush has taken notice. Last month, Crown Prince Abdullah of Saudi Arabia, visiting the president at his Texas ranch on April 25, chided him with the message that his country could send more oil, but the United States would not have the ability to refine it. Soon afterward, Mr. Bush offered to provide closed military bases for new refineries.

Over the last quarter-century, the number of refineries in the United States dropped to 149, less than half the number in 1981. Because companies have upgraded and expanded their aging operations, refining capacity during that time period shrank only 10 percent from its peak of 18.6 million barrels a day. At the same time, gasoline consumption has risen by 45 percent.

But in the last two years, the refining business has experienced a revival of sorts, leading some refiners to predict they have entered an age of higher margins and better returns. Not everyone agrees, but for the first time in a long time the industry is more confident about itself. Even with better economics, however, it is still tough to build a refinery from scratch. Mr. McGinnis says he is not afraid of the challenge. He and his staff work in a small office in Phoenix, mostly consumed these days with securing permits and looking for financial backing.

The next step is to complete an environmental impact statement for the federal Bureau of Land Management. That will include an assessment of the refinery's impact on underground water sources and endangered species, as well as its effect on any Native American burial grounds.

After that, the project needs to get the site's zoning changed by Yuma County from agricultural to heavy industrial; Arizona's preservation office needs to be convinced that the refinery does not trample on any ancient historic site or trail; and finally, the project must apply for a presidential permit, which is issued by the State Department, to allow the crossing of a 200-mile pipeline into Mexico.

The business of turning crude oil into gasoline, jet fuel or heating oil has rarely been a lucrative proposition. It has dismal profit margins compared with its more glamorous cousin, exploration. It is highly cyclical and fairly unpredictable, because demand for gasoline swings sharply by season. And because of low oil prices over the past decades, refiners have been forced into cutthroat competition that has driven many of the smaller refiners out of business.

More refining capacity will almost certainly be needed. Gasoline demand is forecast to rise 39 percent by 2025, to 12.9 million barrels a day, up from today's 9.3 million barrels, according to a long-term outlook by the Energy Information Administration. By then, gasoline alone will account for nearly half the crude oil consumed in the United States.

By contrast, domestic refining capacity is expected to grow only by 0.8 percent from 2005 to 2007, slightly less than the 0.9 percent increase registered between 1998 and 2004, according to Jacques Rousseau, an oil analyst with the investment banker Friedman, Billings, Ramsey.

Jay Saunders, who follows oil companies for Deutsche Bank, said that the increase in refining margins would lead to increased capacity. "The industry is definitely going to overbuild," he said, "they have in the past and they will in the future."

Others caution that the industry should be wary of recreating a glut of capacity that would cause profit margins to sink again. "Refining has been a cyclical business for a long time," said Bill Hauschildt, the vice president for global refining with ChevronTexaco. "In the past few years, there's been much more discipline in the market for not overbuilding capacity."

Part of the issue, according to refiners, is that substantial investments were made over the last decade to lower carbon emissions and meet low-sulfur fuels regulations. The American Petroleum Institute estimates the industry invested $47 billion on such investments. More investments will be needed through 2007 to clean up gasoline and diesel.

"This is going to cost you money and the only thing you will get is cleaner air and less emissions - which are good - but no new capacity," said Edward H. Murphy, the industry group's general downstream sector manager.

"What refiners need are clear guidance on what's permissible and what is not if they want to expand," Mr. Murphy said. "So far, that has not been very clear."

To make up for the domestic shortfall, gasoline imports from Europe and South America have been rising in recent years. Gasoline imports now account for nearly 10 percent of domestic consumption and have exceeded a million barrels a day on average throughout April.

But even as the United States grows more reliant on foreign gasoline, it will face mounting competition from other buyers where demand is similarly growing, like China and India. "More competition means imports might become more expensive," said Joanne Shore, an analyst with the government's Energy Information Administration.

For Bob Slaughter, the president of the National Petrochemical and Refiners Association, the industry's main trade group, "The question now is to keep the growth in imports at a reasonable level." He expects additional capacity will come from expansion of existing projects and not from the construction of new refineries like the one in Arizona.

Even if all goes to plan and investors are found, Mr. McGinnis's envisioned refinery will not be ready before late 2009.

The prospect of a new employer, 3,000 construction jobs and 600 permanent posts has done a lot to outweigh concerns over the project, said John Nussbaumer, the mayor of Wellton, a city of 1,900 people about 20 miles from the refinery site.

"Of course I am concerned about the effects on the environment," he said. "Would I rather see it somewhere else? Yes.

Would I oppose it at this time? No.

It's been too long since a new refinery was built in the United States. Anything we can do to reduce our dependency on the Middle East is a good thing."

Posted 09 May 2005 - 03:30 PM

May 09, 2005

HUFFINGTON POST EXCLUSIVE: EMBARGOED BOOK CLAIMS SAUDI OIL INFRASTRUCTURE RIGGED FOR CATASTROPHIC SELF-DESTRUCTION

According to a new book exclusively obtained by the Huffington Post, Saudi Arabia has crafted a plan to protect itself from a possible invasion or internal attack. It includes the use of a series of explosives, including radioactive “dirty bombs,” that would cripple Saudi Arabian oil production and distribution systems for decades.

Bestselling author Gerald Posner lays out this “doomsday scenario” in his forthcoming “Secrets of the Kingdom: The Inside Story of the Saudi-US Connection” (Random House).

According to the book, which will be released to the public on May 17, based on National Security Agency electronic intercepts, the Saudi Arabian government has in place a nationwide, self-destruction explosive system composed of conventional explosives and dirty bombs strategically placed at the Kingdom’s key oil ports, pipelines, pumping stations, storage tanks, offshore platforms, and backup facilities. If activated, the bombs would destroy the infrastructure of the world’s largest oil supplier, and leave the country a contaminated nuclear wasteland ensuring that the Kingdom’s oil would be unusable to anyone. The NSA file is dubbed internally Petro SE, for petroleum scorched earth.

Edited by advancedatheist, 09 May 2005 - 08:10 PM.

Posted 09 May 2005 - 03:47 PM

Posted 09 May 2005 - 03:51 PM

Posted 10 May 2005 - 10:26 PM

Oil prices rise above $52 a barrel

Worries about OPEC output weighs on crude

The Associated Press

Updated: 3:41 p.m. ET May 10, 2005

VIENNA, Austria - Oil prices rose slightly on Tuesday on speculation that supplies will be tight late in the year, confounding brokers who believe prices should be falling given that crude inventories are steadily rising....

The fear in the market right now is that demand will outstrip supply next winter, as a major OPEC producer said the cartel may not be able to pump enough oil to meet needs for the remainder of 2005. Analysts said bottlenecks in refining capacity have also helped to underpin prices, along with strong demand in Asia.

Prices were given an upward nudge Tuesday after Qatar’s oil minister, Abdullah Hamad al-Attiyah, raised concerns over the Organization of Petroleum Exporting Countries’ capacity to deal with demand for the next Northern Hemisphere winter, when global consumption peaks.

“OPEC is at its highest production in history. I am concerned about that. If we reach the full capacity now, we will tighten in the fourth quarter,” Dow Jones Newswires quoted al-Attiyah as saying.

OPEC pumps around 40 percent of world oil and raised production to about 30 million barrels daily this year in an effort to boost stocks and steady prices ahead of summer. The increased production has some analysts concerned that OPEC is pumping at full tilt, with no spare capacity in the event of an unscheduled outage or a sudden rise in global demand.

Posted 11 May 2005 - 06:25 AM

Solar chimney

A solar chimney is an apparatus for harnessing solar energy by convection of heated air.

In its simplest form, it simply consists of a black-painted chimney. During the daytime, solar energy heats the chimney and thereby heats the air within it, resulting in an updraft of air within the chimney. The suction this creates at the chimney base can be used to ventilate, and thereby cool, the building below. In most parts of the world, it is easier to harness wind power for such ventilation, but on hot windless days such a chimney can provide ventilation where there would otherwise be none.

General concept of proposed solar chimney power stationThis principle has been proposed for electric power generation, using a large greenhouse at the base rather than relying on heating of the chimney itself. The main problem with this approach is the relatively small difference in temperature between the highest and lowest temperatures in the system. Carnot's theorem greatly restricts the efficiency of conversion in these circumstances.

Posted 11 May 2005 - 01:24 PM

Posted 11 May 2005 - 04:00 PM

Makes me think of Dr. Strangelove. I love that movie. And I don't even fully appreciate all its many levels, but I still love it.HUFFINGTON POST EXCLUSIVE: EMBARGOED BOOK CLAIMS SAUDI OIL INFRASTRUCTURE RIGGED FOR CATASTROPHIC SELF-DESTRUCTION

According to a new book exclusively obtained by the Huffington Post, Saudi Arabia has crafted a plan to protect itself from a possible invasion or internal attack. It includes the use of a series of explosives, including radioactive “dirty bombs,” that would cripple Saudi Arabian oil production and distribution systems for decades.

Posted 21 May 2005 - 05:25 PM

Supply: Are Saudi reserves drying up?

By HARIS ANWAR

Friday, May 20, 2005 Updated at 11:31 PM EDT

From Saturday's Globe and Mail

The penny dropped as Matthew Simmons, a Texas-based energy investment banker, sat listening to oil geologists from one of the world's most secretive of companies.

"Our oil challenges: aging fields, rising levels of water, and complex formations," said the Saudi Aramco geologists in a presentation in the Saudi oil city of Dhahran.

Aramco, which controls 98 per cent of Saudi Arabia's oil reserves, has had its doors shut to the outside world for more than 50 years, keeping energy experts guessing about how much oil the kingdom actually has, and how long its gigantic fields can feed oil-thirsty economies such as the United States.

But this revelation from Saudi Aramco's oil geologists in 2003 was enough for Mr. Simmons to spend the next two years trying to solve the mystery surrounding Saudi oil fields.

"This was like a basketball coach saying: I got the world-class athletes, but they are just really old; they are losing their eyesight, and they're starting to use walkers," says Mr. Simmons, the chairman of Simmons & Co., and former member of U.S. Vice-President Dick Cheney's energy task force.

Mr. Simmons is one of those "petro pessimists" whose research shows that the entire Saudi oil system is old and fraying; that its oil production will soon reach an apex, and that the ensuing decline will result in the world confronting an immense oil shortage.

He disputes Aramco's assessment of Saudi oil reserves and future production, pointing to the increasing reliance on pumped water to maintain production from its five big fields, which account for 90 per cent of the kingdom's oil output.

Saudi Arabia produces 9.5 million barrels a day, or more than one-ninth of this year's expected global daily demand of 84 million barrels. The Paris-based International Energy Agency, or IEA, which advises 26 industrialized countries on energy issues, estimates Saudi Arabia has 261.9 billion barrels of "geologically proven" reserves, which are enough for another 25 years to maintain its leading position in the oil market.

Over all, Saudi officials claim, the kingdom may contain up to one trillion barrels of ultimately recoverable oil. It's the only producer in the Organization of Petroleum Exporting Countries (OPEC) cartel that keeps a buffer of spare capacity to swing oil markets when warranted.

But the recent oil price surge, and Saudi Arabia's apparent failure to use its spare capacity, suggest the kingdom's position in the oil supply-and-demand equation is changing.

Posted 15 June 2005 - 04:55 AM

BP says global oil reserves more than enough to meet rising demand

06.14.2005, 11:53 AM

LONDON (AFX) - Oil giant BP PLC believes the world's hydrocarbon reserves are more than adequate to support increasing demand for oil and gas in the coming years.

High energy prices will not be a constraint to investments in the industry, which have risen to record levels over the past year as companies step up efforts to search for more resources in an attempt to boost production.

Based on BP's 2005 Statistical Review of World Energy, released today, the world's proved reserves reached 1.2 trln barrels at end-2004, 17 pct more than they were 10 years ago.

About 62 pct of these reserves, or 734 mln barrels, were found in the Middle East. Saudi Arabia alone holds around 263 mln barrels, or over a fifth of the total.

'Proved reserves of oil and gas remain more than adequate to meet the world's growing needs for the immediately foreseeable future,' Peter Davies, BP's chief economist, told reporters and analysts in a briefing today.

BP says global oil reserves growth stalled in 2004

Tue Jun 14, 2005 4:09 PM BST

By Tom Bergin, European Oil and Gas Correspondent

LONDON (Reuters) - Growth in the world's oil and gas reserves stalled last year, a report from oil giant BP (BP.L: Quote, Profile, Research) showed on Tuesday, bucking a trend that has historically seen new discoveries more than match production.

The BP Statistical Review of World Energy, compiled from official government figures, will reinforce concerns about the ability of global oil supplies to match surging consumption, which grew 3.4 percent in 2004.

The world had 1,188.6 billion barrels of oil reserves at the end of 2004, compared to 1,188.3 billion at the end of 2003, BP, the world's second largest oil firm by market capitalisation, said.

The 0.02 percent growth rate was the lowest since 1990 and compares with a 10-year average above 1.5 percent per annum.

Last year's almost imperceptible rise in oil reserves came despite high prices, which normally help by encouraging new exploration and by making previously uneconomic resources commercial.

Posted 15 June 2005 - 11:24 AM

Posted 15 June 2005 - 07:32 PM

What do you think of the oil shale in the Rocky Mts? It is estimated that there is 1 trillion barrals of oil locked up in it. They also think they have a safe way of getting to it other then grinding up the rock. It it enough to at least put of the looming oil crisis until the people of the world are more willing to accept we have a problem?

Posted 15 June 2005 - 07:47 PM

Posted 15 June 2005 - 09:50 PM

Oil prices cause paving costs to rise

UN. 14 1:49 P.M. ET Warning to motorists this summer: Rough road ahead.

From New England -- where the punishing winters leave roads rutted, cracked and riddled with potholes in the spring -- to the Deep South, repaving projects are being canceled or postponed because of the rising price of oil, which is used to make asphalt as well as diesel for dump trucks, steamrollers and other heavy equipment...

Oil prices have climbed to about $54 a barrel, up about 75 percent from two years ago.

The full effect across the country will not be known until Congress passes a major new transportation spending bill, probably by the end of the month. Then states will know how much federal funding they will be getting.

But the industry publication Engineering News Record reported in April that the 20-city national average price for asphalt, a crude oil derivative, is up almost 13 percent from a year earlier to about $189 a ton.

Oil prices affect the cost of paving in other ways, too. Terrill Temple, county engineer for three Mississippi counties, where some projects have been delayed, said that when 20-ton dump trucks that move materials to a job site get just 5 or 6 miles per gallon, "yes sir, it has a big impact."

Also, contractors are paying higher prices for the No. 2 heating oil used to heat the asphalt so it can be mixed with sand or stone...

Highway engineers said they are seeing cost increases for other materials as well, including concrete, steel and the sand, stone and other aggregates that get blended with asphalt. Those increases stem mainly from the high energy costs of producing the materials.

Posted 15 June 2005 - 10:35 PM

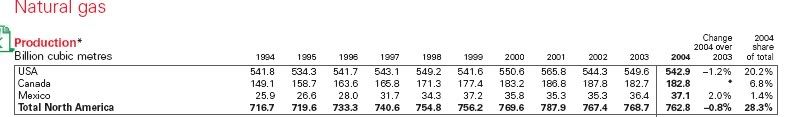

High prices can't make new natural gas supplies magically appear after they have depleted.

Posted 16 June 2005 - 12:43 PM

Glad you asked that. I make the following public offer to the first person who can prove to me that he filled up his tank with gasoline made from misnamed "oil shale" that he or she bought from a commercial filling station: I will pay you US$ 1,000. I feel confident I will never have to pay up because for complicated thermodynamic reasons we will never derive net energy from this resource.

Posted 20 June 2005 - 06:10 AM

No, but high prices will make demand go down and force conservation upon the poeple.

Posted 21 June 2005 - 04:14 AM

US power plants could run short of coal

Mon Jun 20, 2005 06:08 PM ET

By Steve James

NEW YORK (Reuters) - Some U.S. power stations could run out of coal if a long hot summer pushes up demand at plants with already low stockpiles, the chief executive of the No. 2 U.S. coal producer said on Monday.

"I don't think there'll be blackouts but I think there's a possibility in a hot summer that somebody could go very, very low on coal," Arch Coal Inc. (ACI.N: Quote, Profile, Research) Chief Executive Steven Leer told the Reuters Energy Summit. Arch fuels approximately 7 percent of the electricity generated in the United States.

Coal inventories at many power stations are historically low, he said, and rail disruptions have delayed shipments of coal at a time when demand is soaring from higher oil prices.

0 members, 1 guests, 0 anonymous users