Needless to say, I just received an email linking me to the writeup below is I feel is full of questionable conclusions about NR but adds some info on this controversy (from seeking alpha)

In a previous article, I sounded alarm on the stock of ChromaDex (NASDAQ: CDXC) due to its spiking DSO and deteriorating customer credit quality. I laid out a range of possibility on what this could have meant for the company, the stock and investors.

The most benign interpretation as I deduced was a weak Q3. The most severe implication as seen by me was channel stuffing (in article title and main body), or fictitious revenue (via intense discussion with my readers in the comments area).

The company's subsequent Q3 earnings release validated my concern. Q3 net sales collapsed totally, driven by the meltdown of its core ingredients revenue. Q3 net sales declined 43.3% QoQ and 20.4% YoY, respectively, to $5.0 million from Q2's $8.8 million and 3Q15's $6.3 million. Q3's ingredients net sales net sales collapsed to $2.7 million from Q2's $6.2 million (-57% QoQ) and 3Q15's $4.1 million (-36% YoY).

Just compare Q3's net sales performance to Q2's (45% YoY growth, driven by 83% YoY growth in ingredients net sales) and you should have understood why I characterize the Q3 performance as a collapse or meltdown.

Pricing Dispute With Largest Customer

The most shocking revelation from the company's 10-Q was the following:

"We currently have a disagreement with a significant customer, and a disruption in sales to or the ability to collect from this customer, or other significant customers in the future, could materially harm our financial results."

"We currently have a disagreement over the interpretation of certain terms of a supply agreement with a customer that we expect will represent greater than 10% of our net sales for the year ending December 31, 2016. Because of the disagreement, this customer has not paid us approximately $3.0 million for previous purchase orders."

This customer is none other than the company's largest customer, "Customer C", which had an outstanding trade receivable accounting for 48.8% of the total trade receivables, or about $3.2 million, at the end of Q3. And this customer ceased to be the company's largest customer in Q3. Its percentage contribution to net sales went down from Q2's 34.5% to less than 10%, though exact net sales were not disclosed in that filing.

I argued that Customer C was Elysium Health in my previous article. A recent 8-K filing has now confirmed this. This filing made it clear that Elysium's contribution to Q3 net sales amounted to only $180K, or less than 4% of total net sales. And this contribution was entirely attributable to a huge quarter-end purchase order placed in Q2. Elysium didn't place any purchase order in Q3 and Q4. ChromaDex is now suing Elysium for three counts of Breach of Contract as well as one count of Fraudulent Deceit.

So what can we learn from this supplier-customer high drama? Here are some of my thoughts.

1. Niagen's Sustained Growth Is A Myth

Any new products go through an initial phase of phenomenal growth, from zero sales to non-zero sales. Since Niagen was introduced in May 2013, it has gone through a honeymoon period of "phenomenal growth". But that phenomenal growth was due to the low-base-number effect. The challenge is to deliver sustained growth in the long run.

Elysium is supposed to be the key growth engine of Niagen, since this is a company that boasts 7 Nobel Laureates on its Scientific Advisory Board and its Basis product is the most successful among all Niagen supplements due to the company's exceptional marketing prowess.

Now we have learned that Niagen has hit a wall even in a niche that targets affluent consumers who are attracted to the halo (and marketing hype) of famous scientists. Elysium has misrepresented its growth to induce massive price discount from its supplier ChromaDex. Actual growth is far from what you have read in the press or ChromaDex's past quarterly earnings releases.

Then there's CVS, which rolled out a Niagen NR product ("Age Defense") only to withdraw it from the market within less than a year. SNG (Specialty Nutrition Group, Inc.) appears to have followed CVS' footstep. It rolled out the F1RST brand of Niagen in GNC stores a year ago. The product appears to have quietly disappeared from GNC website. As of today (1/8/2017), if you search for Niagen on GNC website, the only product that returns is Jarrow Formulas Nicotinamide Riboside.

CVS, and potentially SNG as well, likely have figured out that marketing an extremely expensive version of vitamin B3 is not exactly a profitable endeavor. And this brings me to my second point.

2. Niagen Is An Expensive Vitamin B3. Pricing Is The Devil.

There's no doubt that Niagen NR is capable of boosting NAD+. But the problem is that all three variations of vitamin B3 are capable of accomplishing the same (at differing efficacy). If you are just slightly familiar with the science of NAD+ precursor metabolism (Preiss-Handler Pathway, NAD+ Salvage Pathway, etc.), you should have known that all three variations of vitamin B3, NR, NAM (Nicotinamide), and NA (Nicotinic Acid) are precursors of NAD+. All three produce NAD+ in the human body.

NAM is quite close to NR in boosting NAD+ in terms of equimolar efficacy. In ChromaDex's own study (mouse gavage/first clinical study by U. Iowa/Queens U./ChromaDex), NR achieves higher NAD+ boosting efficacy than NAM, but the difference was not statistically significant.

For consumers like me, who are wary of NAM's potential sertuin-inhibition effect, they can still use NA to achieve the same effect. NA and NAM are much cheaper than NR. By my calculation, NA can achieve the same level of NAD+ boosting effect at 1/70 the cost of Niagen NR.

NA does cause the unpleasant flushing side effect on some consumers. However, the side effect diminishes after extended period of use. I have used NA for months now and have used to the flushing side effect that has diminished gradually.

Consumers who don't mind NAM's potential sertuin inhibition impact can achieve the same result at even greater savings than using NA. Like NR, NAM is a no-flush version of vitamin B3.

Given NR is so much more expensive compared to its siblings (NAM and NA), there's no wonder that pricing is the key battleground in Niagen's vendor-customer relationship. There will be increasing pricing pressure from customers as the sales stall out. Now that ChromaDex's pricing dispute with Elysium has gone public, other customers might have gained more weapons in their pricing negotiation with ChromaDex.

Investors should also be informed that exercise, fasting, or caloric restriction can also boost NAD+ at virtually zero monetary cost.

3. Elysium Is Playing Timing Game To Gain Price Concession

The Elysium drama is a classical case of timing game being played between a supplier and its customers. When a supplier is under pressure to deliver numbers toward of the end of a quarter or year, it is more willing to make concession to its price. Companies engaged in this period-end pricing concession strategy are basically engaged in the practice of channel stuffing. When customers found this out, they are more likely to hold on their purchase order to the end of a quarter or year to induce price concession from their suppliers.

Elysium placed a monster order on June 28th. Though that order was not delivered, it triggered an outsized order that was placed on June 30th and was fulfilled on July 1st, only one day before the end of ChromaDex's fiscal 2Q16. That was how ChromaDex managed to report ingredients net sales growth of 83% for that quarter.

Of course, Elysium's drama went beyond timing of purchase order. It also involved immense pulling-in of future demand into a single order to induce price concession. But there's no argument that timing tactic was also in play here.

4. Expect Weak Net Sales In Coming Quarters

Elysium has not placed any order in Q3 and Q4. It pulled in its future Niagen demand in 2016 and the supply should be able to last into early 2017. With the demand from this top customer having totally dried up, expect to see weak sales figure in Q4 and 1Q17.

5. Suspicion of Recognizing Disputed Revenue

From the 8-K filing, it's obvious that ChromaDex was willing to address Elysium's pricing concern. With pricing dispute going on, ChromaDex rushed to deliver the huge June 30th order right before the end of Q2. The order was subsequently recognized as Q2 revenue. From the time of delivery of the purchase order to the time 10-Q was filed, the pricing dispute was still going on. This raises the question of if the company has knowingly recognized revenue in dispute. If yes, this would be in violation of GAAP accounting rules.

Of course, if the court rules entirely to the company's favor, the blame could be squarely placed on Elysium's shoulder. But so far we have only heard ChromaDex's one-sided argument. Any counter-claim from Elysium or this court proceeding alone might reveal a lot more regarding what has actually occurred behind the curtain.

There's also the likelihood of a settlement. The company can settle for less than the nominal amount of receivables owed. That would also be a proof that management knowingly recognized revenue in dispute in 2Q16.

6. Deteriorating Credit Quality Implies More Widespread Customer Problem

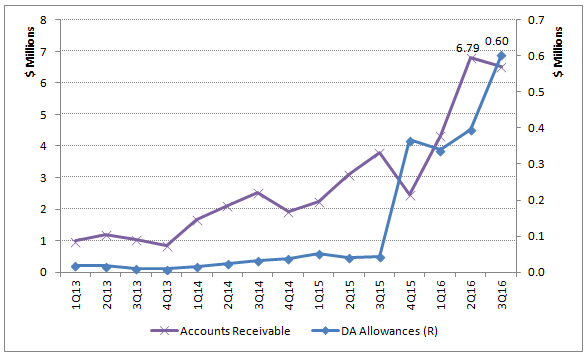

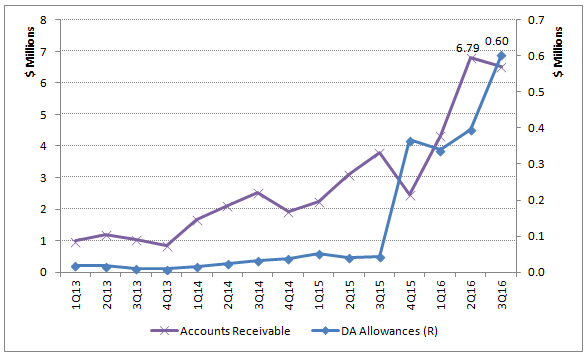

As pointed out in my previous article, ChromaDex's customer credit quality has deteriorated since 4Q15. This can be seen from the chart below that plots the trend on AR (accounts receivable) and DA (doubtful accounts) allowances since 1Q13.

Chart 1. A/R and Doubtful Accounts Allowances trend 2013-16. (Source: author, based on public filings.)

Don't rush to assume that the DA allowances were due to the Elysium dispute. Recall that the Elysium dispute involved $2,983,350 in purchase order plus some royalty revenue as well. As revealed in the 8-K filing, the total amount in dispute has now amounted to no less than $3,983,350, or almost $4 million.

The $603K DA allowances amounted to nothing when compared to the disputed revenue with Elysium. So, most likely they were attributable to other customers. Some simple math would tell you that the DA allowances were a whopping 18.1% of the total AR balance less what was owed by Elysium, as of the end of Q3.

Such low customer credit quality should not be taken lightly because it is a warning that the quality of the revenue or net sales is questionable as well.

Final Remarks

Elysium Health reported positive clinical trial on its Basis supplement product, which cheered the investing community. But when you think through it, the clinical trial result is nothing unexpected. If you are just slightly familiar with the science of NAD+ precursor metabolism (Preiss-Handler Pathway, NAD+ Salvage Pathway, etc.), you should have been aware that all three variations of vitamin B3, NR, NAM, and NA, serve to produce/boost NAD+ in the human body.

Yes, NR is slightly more potent than NA and NAM in boosting NAD+ on an equimolar basis. But why should that matter much when it is orders of magnitude more expensive than NA and NAM?

The high drama between ChromaDex and its top customer Elysium Health should have taught investors a thing or two. Looking beneath the surface, a lot of red flags are lurking and call for a cautious approach when considering this company as a long-term investment candidate.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This topic is locked

This topic is locked